Table of Contents

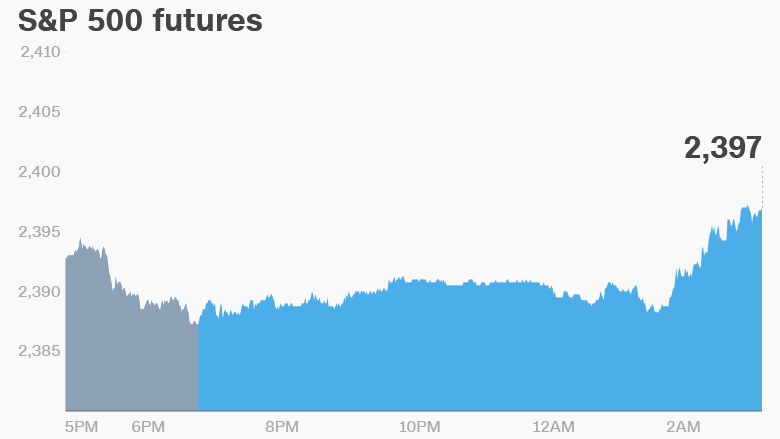

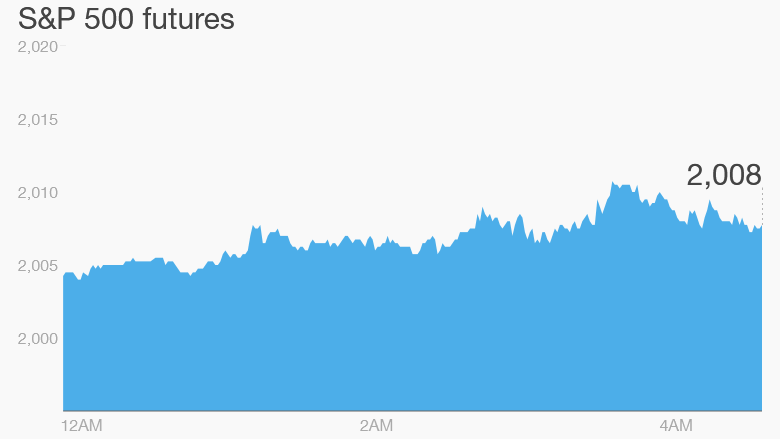

- Premarket: 5 things to know before the bell

- Premarkets: 3 things to know before the open

- Pre Market - YouTube

- Pre-market Trading - An In-Depth Guide for Traders

- Pre-Market Trading - Meaning, Advantages, Risks, And Examples

- Get to know about the pre-market trading – UC Micro Finance

- When do I trade Pre-Market? - YouTube

- Pre-Market Trading: How It Works, Benefits, and Risks

- Pre-market Hours: What Time Does the Pre-Market Open?

- Premarket Trading: The Complete Guide For Traders

Understanding Pre-Market Trading

:max_bytes(150000):strip_icc()/premarket.asp-final-cac4cee899af4acc8537ba1d6df84bbd.png)

Factors Influencing Pre-Market Trends

Leveraging Pre-Market Data for Investment Decisions

Investors can utilize pre-market data to gauge potential market movements and make strategic decisions: - Identifying Trends: Monitoring pre-market activity can help in identifying early trends that may continue into the regular trading session. - Risk Management: Understanding pre-market volatility can aid in setting appropriate stop-loss levels and managing risk. - Opportunity Identification: Pre-market trading can reveal opportunities for buying or selling stocks based on after-hours earnings reports or news releases.

Tools and Resources for Pre-Market Analysis

Several tools and resources are available to help investors analyze pre-market trends: - Financial News Websites: Sites like Bloomberg, CNBC, and Reuters provide real-time news and analysis. - Stock Screeners: Tools that filter stocks based on specific criteria, including pre-market movers. - Trading Platforms: Many platforms offer extended-hours trading capabilities and real-time data.

For the latest updates and insights on pre-market trends and stock market analysis, visit our website or subscribe to our newsletter to stay ahead of the curve.

Stay informed, invest wisely.